Table of Contents

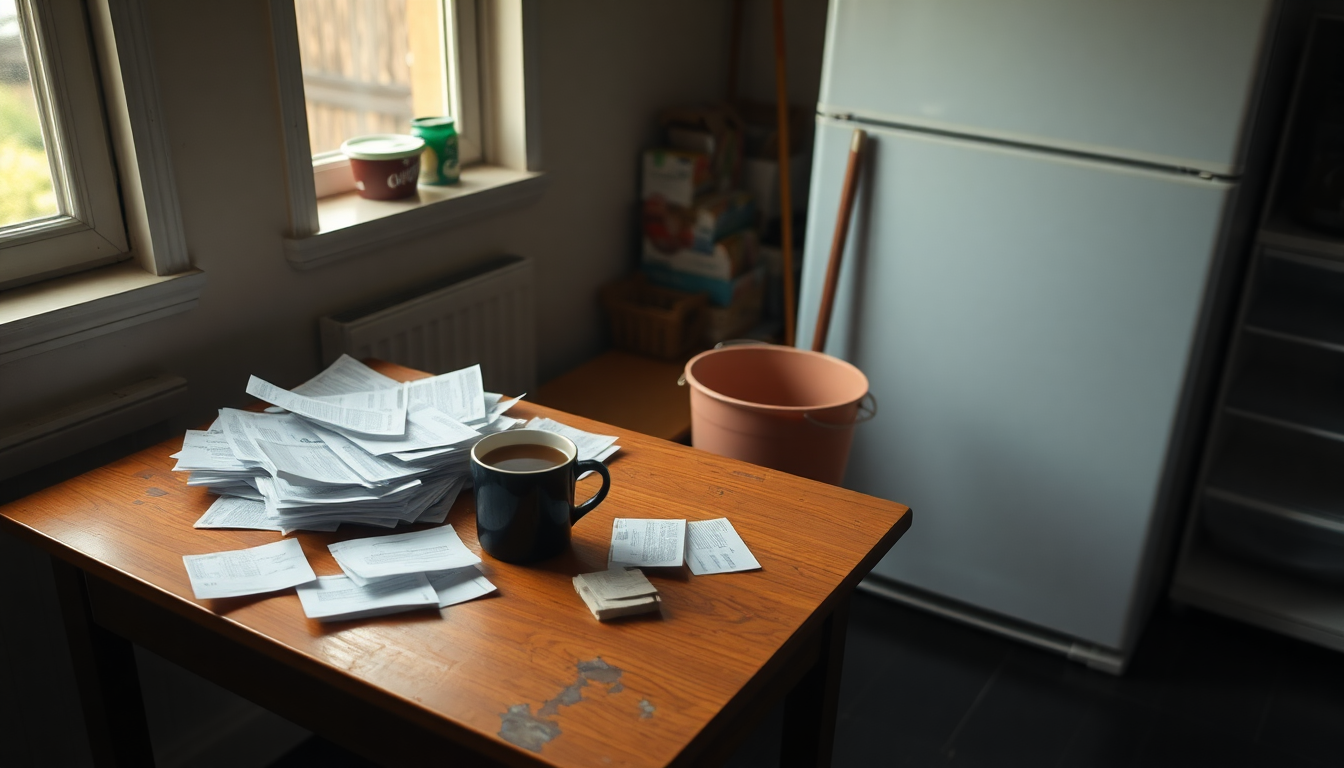

Imagine waking up one morning, your world turned upside down, and you’re left scrambling to figure out how to keep the lights on and the fridge stocked. Welcome to the life of Jane Woodcock, a 68-year-old woman who, after losing her husband in 2018, faced the cruel reality of financial uncertainty. It’s not just her story; it’s a narrative that’s becoming all too common among seniors today. As prices skyrocket, Woodcock found herself dusting off her cleaning supplies and diving back into the workforce, a role she never thought she’d have to play again.

The rising tide of costs

In 2019, just as the world was about to plunge into a pandemic, Woodcock began to notice the relentless increase in prices. Everything from groceries to utilities felt like a slap in the face, making her realize that retirement was a luxury she couldn’t afford. “I thought I’d be retired,” she laments, reflecting on a life once supported by her late husband, who was the breadwinner. Now, with five animals and a mortgage, her financial reality is a stark contrast to the peaceful retirement she envisioned. Isn’t it just delightful to think that retirement could become a pipe dream for those who’ve worked hard their entire lives?

Unretirement: A new trend

According to a 2024 report from Resume Builder, about 40% of seniors have found themselves back in the workforce. The reasons? A cocktail of soaring living costs and insufficient savings. Woodcock’s situation underscores this trend. She has two dogs, two cats, and a potbellied pig, all of which contribute to her ever-growing expenses. “Every time I go into the grocery store, the prices are double,” she states, her frustration palpable. It’s maddening, isn’t it? One minute you’re living your best life, and the next you’re pinching pennies to afford pet food.

Making sacrifices

With rising costs, Woodcock has had to make some hard sacrifices. Gone are the days of cable TV and carefree heating or cooling of her home. “If you’re hot, you should be allowed to turn on the air conditioner,” she argues, highlighting the absurdity of having to choose between comfort and financial stability. Yet, here she is, living in a world where basic comforts seem like a luxury. Her monthly income, a mix of her job and her late husband’s pension, barely covers her expenses. With around $4,000 a month to juggle mortgage payments, insurance, and food, it’s a constant battle against the clock. “It’s a mix, and it’s still not enough,” she concludes, almost resigned to her fate in this cruel economic landscape.

The harsh reality of modern retirement

So here we are, at a time when retirement is supposed to be about relaxation and enjoying the fruits of one’s labor, and yet it’s morphing into a nightmare for many. Woodcock’s story is a mere reflection of a larger systemic issue that leaves countless seniors feeling abandoned and struggling. How did we get here? Why are those who worked their entire lives now facing the prospect of unretiring? The answers are as frustrating as they are alarming, and they demand attention.