Table of Contents

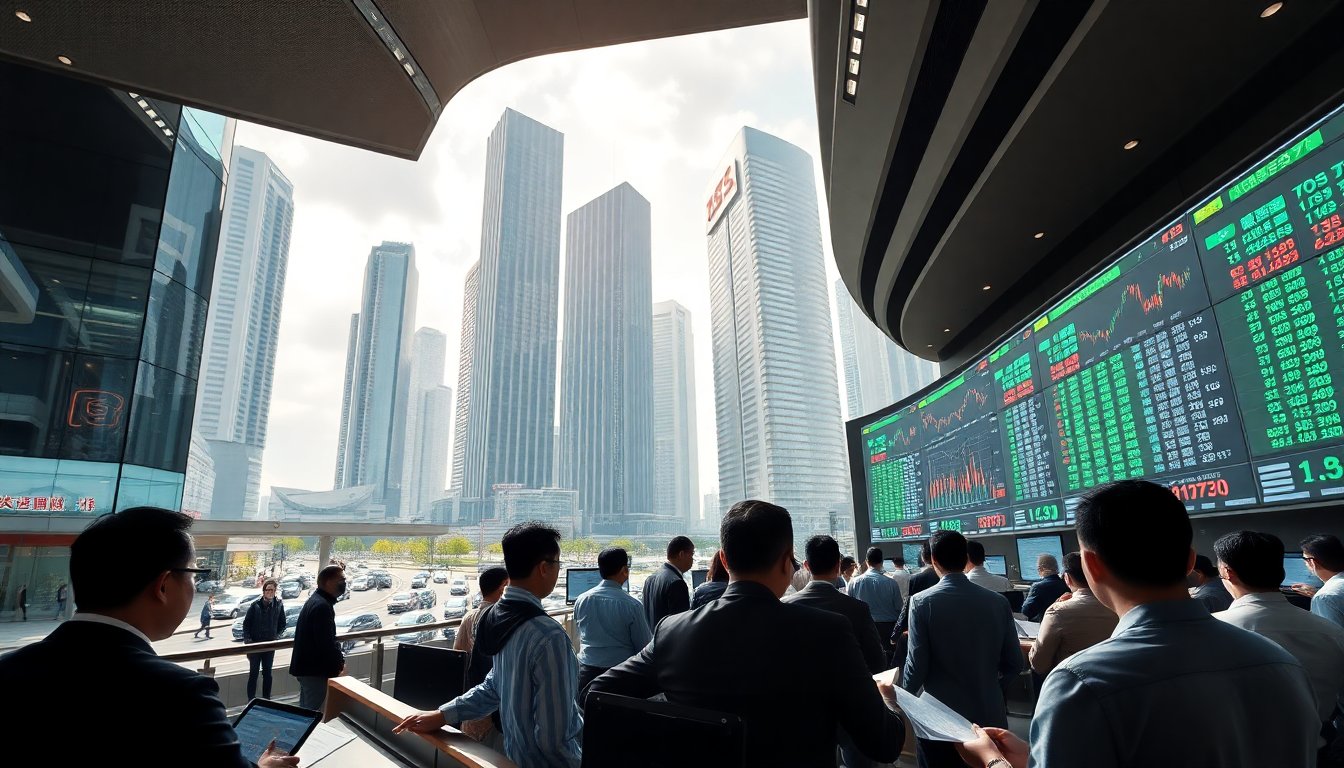

The Chinese stock market has recently attracted global attention due to its significant gains, prompting careful navigation by regulators. As Beijing seeks to position its US$12 trillion equity market as a dependable source of household income, the focus shifts to balancing growth with stability. Lessons from the past two decades of market volatility may guide the government’s efforts towards a sustainable bull market, akin to those in major economies such as the United States, India, and Japan.

Understanding the Current Market Landscape

In recent years, the fluctuations within the Chinese stock market have been notable, characterized by rapid booms followed by sharp corrections. This cycle raises concerns among policymakers regarding the long-term viability of such volatility. The current emphasis is on fostering a more stable investment environment, encouraging households to diversify their wealth away from real estate, which constitutes approximately 60% of family assets in China.

Data analysis reveals that the recent gains in stock prices reflect a growing confidence among investors. Financial regulators are intent on mitigating the risks associated with erratic price movements that could lead to panic selling and significant market disruptions. Therefore, the moderation in stock price increases following last week’s pullback is seen as a positive development, indicating a potential shift towards a more measured bull market.

Trends Shaping the Future of the Market

Market analysts are observing a transition from unidirectional gains to a more gradual upward trend. This shift may signify the maturation of the market, where volatility persists but is tempered by an enhanced sense of investor confidence. Experts note that while fluctuations will continue, the fundamental uptrend is likely to remain intact.

This evolving landscape presents potential opportunities for investors. A stable stock market can significantly drive consumer spending, which has been sluggish recently. By leveraging stock market gains, households may discover new income avenues, thereby supporting broader economic growth. The regulators’ focus on creating a stable environment is crucial for sustaining growth and preventing a return to past erratic behaviors.

Strategic Considerations for Investors

For investors aiming to benefit from these developments, understanding the nuances of the current market environment is vital. The regulatory landscape is evolving, necessitating adaptive strategies. Identifying sectors poised to gain from increased consumer confidence and household wealth diversification will be critical.

Looking ahead, it is important to remain vigilant and adaptable. The trajectory of the Chinese market will be influenced by domestic factors, as well as global economic trends and geopolitical dynamics. Monitoring these elements will equip investors with the insights needed to navigate this complex landscape effectively.

Looking Ahead: Predictions and Insights

The medium-term outlook for the Chinese stock market suggests cautious optimism. As regulators implement measures to stabilize the market, investors may witness a gradual resurgence of confidence. The focus will likely remain on sustainable growth, steering clear of the extremes seen in the past.

Ultimately, the success of this transition will depend on regulators’ ability to maintain a delicate balance between encouraging investment and managing risks. The insights gained from previous market cycles will play a pivotal role in shaping the future of China’s equity market, as it strives to become a stable contributor to the national economy.