Table of Contents

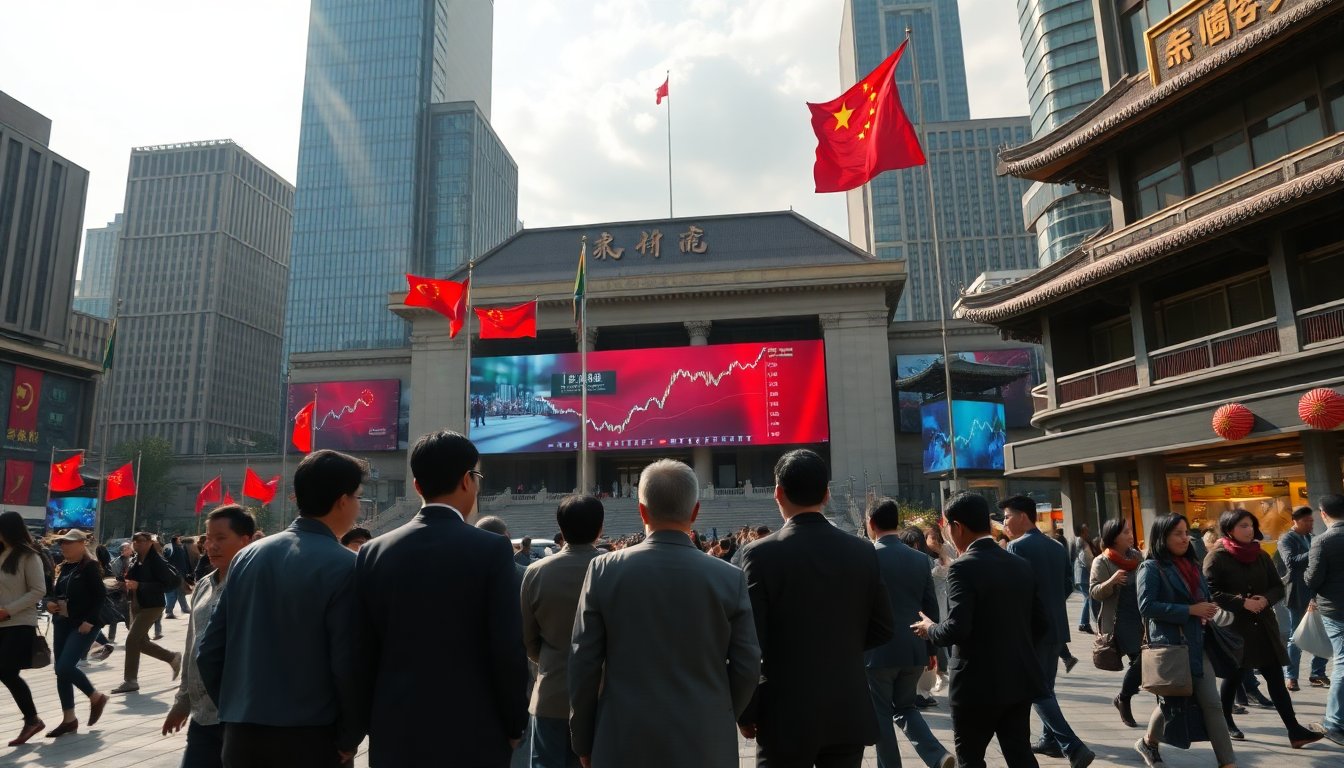

In a bid to strengthen its finances, the Chinese government has implemented tax increases across several sectors. This move has sparked considerable discussion among economists and market participants. The decision follows a notable drop in fiscal revenues that occurred late in, raising questions about the sustainability of such measures and their broader economic implications.

Speculation is rife regarding further tax reforms, with the adjustments causing fluctuations in the market. Some analysts view these tax hikes as a temporary fix, while others express concern that they may signal tougher economic times ahead for various industries.

Understanding the tax changes

The recent announcement from Beijing highlighted the tightening oftax incentivesand the elevation of preferential rates in targeted industries, including telecommunications and other sectors critical to the national economy. This strategic maneuver aims to enhance government revenues at a time when fiscal health appears precarious.

Late in, the Chinese government faced a significant revenue shortfall, prompting a need for swift action to stabilize finances. The decision to raise taxes is not merely reactive; it reflects a broader strategy to recalibrate fiscal policies in light of changing economic conditions.

Potential impacts on industries

Economists are divided on the potential outcomes of these tax adjustments. Some believe that the increased financial burden on sectors like telecommunications may stifle innovation and growth. Conversely, proponents argue that increased revenue could lead to greater investment in public services and infrastructure.

Despite the rationale behind these tax hikes, concerns persist that if market conditions do not stabilize, the adjustments may lead to longer-term economic challenges. A significant number of analysts are closely monitoring how these changes will affect consumer spending and

Market reactions and future outlook

The immediate aftermath of these tax changes has seen increased volatility in financial markets, with investors reacting to the implications of higher operational costs for businesses. This reaction reflects broader unease regarding the future economic landscape in China.

As the government seeks to balance fiscal needs with economic growth, many are questioning whether these tax hikes will serve as a sustainable solution or merely a stop-gap measure. The success of these adjustments will largely depend on the government’s ability to manage the economic fallout and restore confidence among investors and consumers alike.

Looking ahead

China’s recent tax reforms mark a critical juncture in the nation’s economic policy framework. As the government grapples with declining revenues, these changes underscore the challenges ahead. Stakeholders across various sectors must remain vigilant, as the impacts of these tax hikes will unfold in the coming months.

The path forward will require a delicate balance between generating necessary revenue and fostering an environment conducive to growth and innovation. Ultimately, the effectiveness of these tax policies will be pivotal in shaping China’s economic landscape in the years to come.